EXTREME NETWORKS (EXTR)·Q2 2026 Earnings Summary

Extreme Networks Beats Q2 as Platform ONE Bookings Double, Stock Jumps ~10%

January 28, 2026 · by Fintool AI Agent

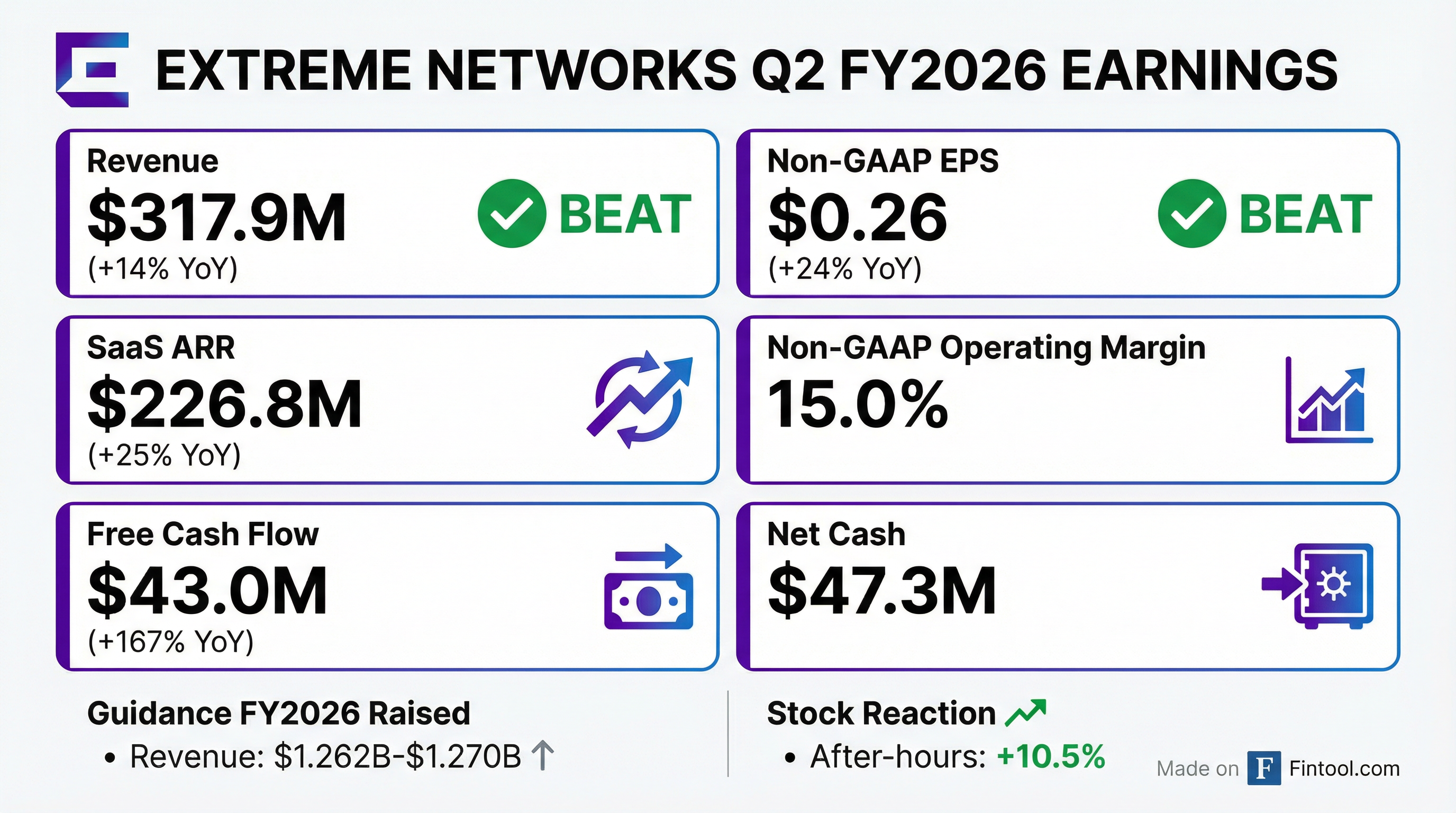

Extreme Networks (NASDAQ: EXTR) delivered a double beat in Q2 FY2026, with revenue of $318 million (+14% YoY) and non-GAAP EPS of $0.26 (+24% YoY), both exceeding Wall Street expectations. The company's AI-powered Platform ONE saw bookings "twice our plan," driving shares up nearly 10% in after-hours trading.

Did Extreme Networks Beat Earnings?

Yes — Extreme beat on both the top and bottom line.

This marks seven consecutive quarters of revenue growth. Over the past 12 months, Extreme has grown 3x faster than its largest competitors in enterprise networking.

CFO Kevin Rhodes noted: "Earnings per share grew from $0.21 in the prior year quarter, a 24% year-over-year improvement. Our profit growth rate outpaced our revenue growth rate by 10 percentage points."

What Did Management Guide?

Extreme raised full-year revenue guidance, signaling continued momentum despite supply chain volatility.

Q3 FY2026 Guidance (March Quarter)

Note: Q3 and Q4 gross margins will be impacted by large venue deployments with professional services. CFO Kevin Rhodes: "We have several multimillion-dollar deployments at large venues which we will deliver during the third and fourth quarter. These customers have asked Extreme to run point on the installations with our professional services team. Installation services carry a much lower margin profile."

Full Year FY2026 Guidance (Raised)

Management reiterated their long-term gross margin target of 64-66%, with CFO Kevin Rhodes expressing confidence: "We expect the combination of the actions we have taken and a vigilant approach to supply chain planning to result in further improvement in our gross margins over time."

CEO Ed Meyercord on the full-year outlook:

"For the remainder of fiscal 2026, we expect to continue to grow profit faster than revenue, with expected profitability growth of around 20% on double-digit revenue growth for the year. We're set up with a solid foundation exiting the second quarter, with well over $200 million of annualized EBITDA at a healthy net cash position."

What Drove the Beat?

Platform ONE Momentum

The standout metric was Platform ONE bookings at 2x plan. This AI-powered networking platform is winning deals against larger competitors by simplifying operations and automating complex tasks. The company closed 34 deals over $1 million this quarter, highlighting its ability to move upmarket.

Key Platform ONE wins this quarter included:

- Large retail customer — Multimillion-dollar Platform ONE sale to centrally manage network across 3,000 stores

- Large U.S. school district — Multimillion-dollar full network refresh (wired, wireless, SD-WAN, AI platforms) — won over Juniper in head-to-head evaluation

- Baylor University, Henry Ford Health, University Hospitals Birmingham NHS, Pittsburgh Steelers — Wi-Fi 7 deployments

- TJ Regional Health (Kentucky) and Groupe Jolimont (Belgium) — Full network modernization with Extreme Fabric

- SK Bioscience (Korean biotech) — Platform ONE for expanded offices and new R&D center

Competitive Tailwinds — Cisco EOL + HP-Juniper Merger

Management highlighted multiple structural tailwinds creating share gain opportunities:

"A major end-of-life refresh cycle and changes to the partner program at Cisco are creating a significant multi-year growth opportunity for Extreme, worth billions in total addressable market. And the HP-Juniper merger is creating share gain tailwinds for us as well."

CEO Ed Meyercord noted they've recruited "top-level talent from Juniper, who see tremendous opportunity at Extreme, including two at the SVP level, in leadership positions, in global channel and EMEA sales."

MSP Partner Momentum

The company saw strong momentum with managed service providers:

- MSP partners nearly doubled year-over-year

- MSP billings up 3x year-over-year

- New "Extreme Partner First" program launched last week with simplified deal registration, transparent pricing, and AI-embedded partner experience

- Partners can make 20% more profit at Extreme than competitors

Enterprise Networking Leadership

Extreme was named a Leader in the IDC MarketScape for Enterprise Wireless LAN (October 2025), with recognition for Platform ONE, high-density expertise, and flexible deployment options.

Financial Highlights

Revenue by Geography

Extreme saw strong YoY growth across all regions this quarter:

The balanced Americas/EMEA split (47%/44%) demonstrates Extreme's global reach and diversified customer base, reducing single-region dependency.

The gross margin compression (-140 bps) reflects product mix and supply chain costs, but was more than offset by operating leverage, with operating margin expanding 30 bps.

How Did the Stock React?

Shares surged nearly 10% in after-hours trading, recovering from a -3.3% decline during the regular session.

The after-hours rally suggests investors are rewarding the revenue beat, guidance raise, and Platform ONE momentum. The stock remains well below its 52-week high, presenting potential upside if execution continues.

What Changed From Last Quarter?

The most notable improvement is the 170 bps expansion in operating margin sequentially, demonstrating the leverage in Extreme's model as revenue scales. The balance sheet also strengthened significantly, with net cash improving by nearly $40 million.

Recurring Revenue Visibility

Extreme's subscription-based recurring revenue continues to build long-term visibility:

The $628M deferred recurring revenue balance provides significant future revenue visibility. CFO Kevin Rhodes explained the ARR acceleration:

"It is absolutely just a product of a really good platform, a simple licensing model that includes the cloud management, includes the Agentic AI, includes the support contracts. People like that model — it's simple, they understand what the pricing is, they're not gonna have hidden costs in the future. Our customers really enjoy the Agentic AI... It's like adding an extra engineer to their team."

Balance Sheet & Capital Allocation

Extreme's financial position has dramatically improved over the past year:

Free cash flow generation accelerated to $43.0 million in Q2, up 167% year-over-year, driven by improved working capital and higher operating income.

Risks and Concerns

-

Supply Chain Volatility — Management explicitly called out "ever-changing supply chain conditions" as an ongoing challenge.

-

Gross Margin Pressure — Non-GAAP gross margin contracted 140 bps YoY to 62.0%, reflecting mix shift and component costs.

-

Q3 Guidance Implies Deceleration — Q3 revenue guidance of $309-$314M suggests a sequential decline, though this may reflect typical seasonality.

-

Tariff Exposure — The forward-looking statements mention potential tariff impacts as a risk factor.

Q&A Highlights

Share Gain Evidence

Analyst Mike Genovese (Rosenblatt) asked for evidence of market share gains. CEO Ed Meyercord explained they use third-party analysts like 650 Group and Dell'Oro for validation:

"When I say we're growing at three times the market, we're using third-party industry data, looking at the enterprise deployments, which is campus enterprise data, data center, etc."

He credited Norman Rice (sales leader for 2 years) for bringing "discipline into the process" and improving forecast accuracy, alongside CMO Monica Kumar's marketing overhaul with 19 targeted "pods" combining direct sales, localized marketing, and channel resources.

Competitive Displacement — Wi-Fi + Switching

Tomer Zilberman (Bank of America) asked whether Extreme is displacing competitors' Wi-Fi and switching simultaneously or landing in one area first. Ed noted it varies by project, with different entry points:

- Germany — Cloud choice/data sovereignty requirements opened the door

- Japan — Fabric over SD-WAN won massive government contracts

- Enterprise refresh cycles — Fabric technology is the "hottest" differentiator

The CEO quoted a Fortune 100 customer:

"What takes Cisco six hours, takes Extreme six minutes... The agility and the speed of turning up network and provisioning network, as well as the delivery of service, as well as the resiliency of the platform — when we get into a head-to-head competition, our competitors can't replicate it."

7% Price Increase — "Non-Issue"

Tomer also asked about customer reaction to the mid-single-digit price increase. Ed called it a "non-issue":

"It's like a tree falling in the forest. A total non-issue... If you think about an organization, there's no discussion about whether or not you need a network, and that you need a modern network. So this is kind of a non-negotiable."

On supply chain, Extreme's teams found alternative DDR4 memory chips from another industry's aging inventory, got them certified by Broadcom, and unlocked a new supply source:

"Our size is somewhat of an advantage... We're solving for fewer problems. We're solving for enterprise networking, switches, and access points. Our competitors have much bigger portfolios."

Agentic AI Platform

Mike Genovese asked about AI relevance. Ed highlighted Extreme's agentic AI core as a key differentiator:

"We're probably the only networking vendor that has an agentic AI platform, where our AI sits at the core of the platform... We doubled our forecast for subscription bookings for Extreme Platform One, which is our AI platform."

EMEA Record and Data Sovereignty

Ryan Koons (Needham) noted EMEA had a record or near-record quarter. Ed explained data sovereignty positioning is a tailwind:

"When you talk about data sovereignty, if you talk to the Gartner group, they'll tell you that Extreme is the only player in the networking space that can deliver a data sovereign solution. As government coalitions in Europe form and get organized around creating budgets, we're starting to see government spend come back."

CFO Kevin Rhodes added they recently hired a new EMEA sales leader who sees "plenty more opportunity" in the region.

Ruckus Acquisition Speculation

Dave Kang (B. Riley) asked about Ruckus acquisition rumors. Ed declined to confirm but signaled openness:

"At Extreme, our policy, if assets or businesses are potentially for sale or potentially available in the marketplace, we're always going to have a look... Anything that we do would have to be accretive. But at this point, that's conjecture. There's really nothing for us to comment on."

FY2027 Outlook Discussion

Christian Schwab (Craig-Hallum) asked about double-digit growth continuing into FY2027. Ed was optimistic but Kevin cautioned it's too early to guide:

Ed: "What you're saying makes a lot of sense to me, because we're seeing this continuation of not only demand in the marketplace, but the strengthening of our competitive position, especially considering what's going on with the larger two players."

Kevin: "We feel comfortable with the FY2027 setup. Obviously, we are not guiding to 2027 yet... This market is pretty dynamic right now."

Professional Services Margin Detail

Eric Martinuzzi (Lake Street) asked about the gross margin impact from large deployments. Kevin clarified:

"Professional services installations have a much lower margin than our subscription and support, which tends to be in the 70% range. These are in the 15%-20% range of margin."

Ed added that in some cases, customers ask Extreme to handle cabling work, which they subcontract and mark up 10-15% — "almost like doing a favor for a customer in a large, complicated project."

Tariffs — "Non-Issue"

Dave Kang asked about tariff concerns. Ed dismissed them:

"Changing tariffs is a way of life for all of us, especially with the current administration in the U.S. This is a core competency at Extreme, so we're well-versed at manipulating and managing through a changing tariff environment. At this stage, it's a non-issue for us."

Key Takeaways

- Double beat — Revenue +1.8% and EPS +8.3% vs. consensus

- Platform ONE is the growth engine — Bookings at 2x plan; CEO says it's "doubling our forecast"

- 7 consecutive quarters of growth — Growing at 3x the market per third-party data (650 Group, Dell'Oro)

- SaaS ARR +25% YoY — Recurring revenue building visibility with $628M deferred balance

- Guidance raised — Full-year revenue now expected at $1.262B-$1.270B

- 7% price increase absorbed — "Total non-issue" with "zero pushback" from customers

- Cisco displacement accelerating — "What takes Cisco 6 hours takes Extreme 6 minutes" per Fortune 100 customer

- EMEA tailwind — Record/near-record quarter; data sovereignty positioning unique in industry

- Stock +10% after-hours — Market rewarding execution and raised outlook

Read the full Q2 FY2026 Earnings Call Transcript for detailed management commentary.

View Extreme Networks Company Page for full financial history and documents.